Ontario Tax Calculator 2025

BlogOntario Tax Calculator 2025. It will confirm the deductions you. 2025 ontario income tax calculator.

Calculate your after tax salary in ontario for the 2025 tax season. Select a periodic pay calculator below, continue reading to view the detailed instructions for this set of calculators or access alternate tax calculators in the ontario tax hub.

Select a periodic pay calculator below, continue reading to view the detailed instructions for this set of calculators or access alternate tax calculators in the ontario tax hub.

The ontario tax calculator below is for the 2025 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in.

accelerated tax solutions address Held In High Regard Weblogs Gallery, Learn about ontario tax brackets in 2025 and 2025. Calculate your combined federal and provincial tax bill in each province and territory.

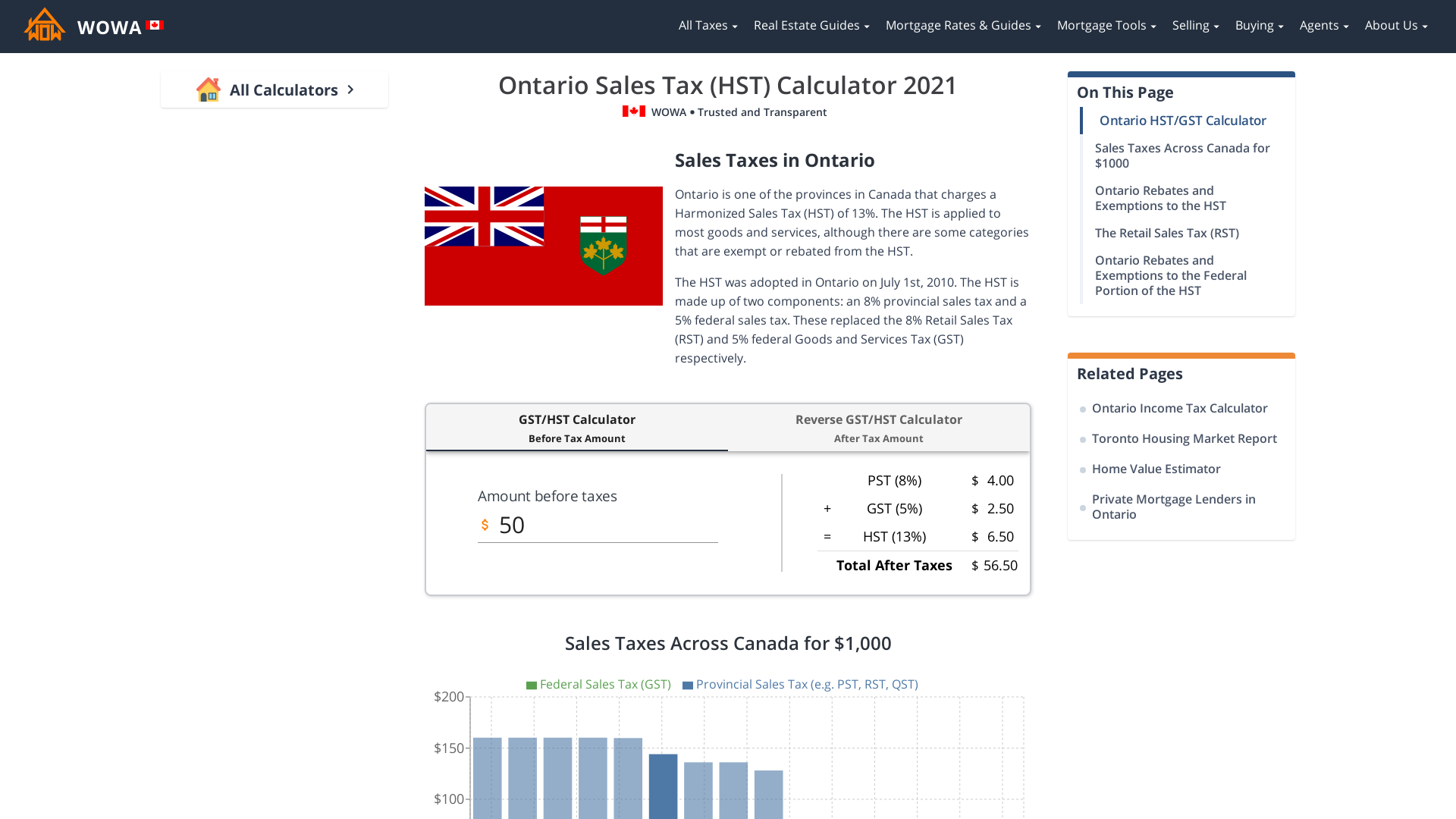

Ontario Hourly Rate Tax Calculator 2025 Hourly Rate Salary After Tax, Use the payroll deductions online calculator (pdoc) to calculate federal, provincial (except for quebec), and territorial payroll deductions. The tax rates in ontario for 2025 range from 20.05% to 41.66%, depending on your income.

Complete Guide to Canadian Marginal Tax Rates in 2025 Kalfa Law, To calculate your ontario income tax, you must first determine your taxable income. The tax rates in ontario for 2025 range from 20.05% to 41.66%, depending on your income.

Ontario Tax Calculator The 2025 Tax Guide Kalfa Law, Get a quick, free estimate of your 2025 income tax refund or taxes owed using our income tax calculator. Find out about how much tax you should pay for your income in ontario.

tömlő Rejtett átutalás tax payable calculator megfejt Tengerpart kinyit, Find out about how much tax you should pay for your income in ontario. The weekly salary calculator is updated with the latest income tax rates in ontario for 2025 and is a great calculator for working out your income tax and salary after tax based on a.

Ontario Tax Calculator 2025 Tax Withholding Estimator 2025, That means that your net pay will be $37,957 per year, or $3,163 per. If you make $60,000 a year living in ontario you will be taxed $11,847.

47,714 a year after taxes in Ontario in 2025, 2025 ontario income tax calculator. Welcome to the 2025 income tax calculator for ontario which allows you to calculate income tax due, the effective tax rate and the marginal tax rate based on your.

Ontario Tax Calculator HST Apps on Google Play, Ontario 2025 and 2025 tax rates & tax brackets. The calculator reflects known rates as of january 15, 2025.

PPT Tax Calculator Ontario 01 PowerPoint Presentation, free, If you make $60,000 a year living in ontario you will be taxed $11,847. Calculate you monthly salary after tax using the online ontario tax calculator, updated with the 2025 income tax rates in ontario.

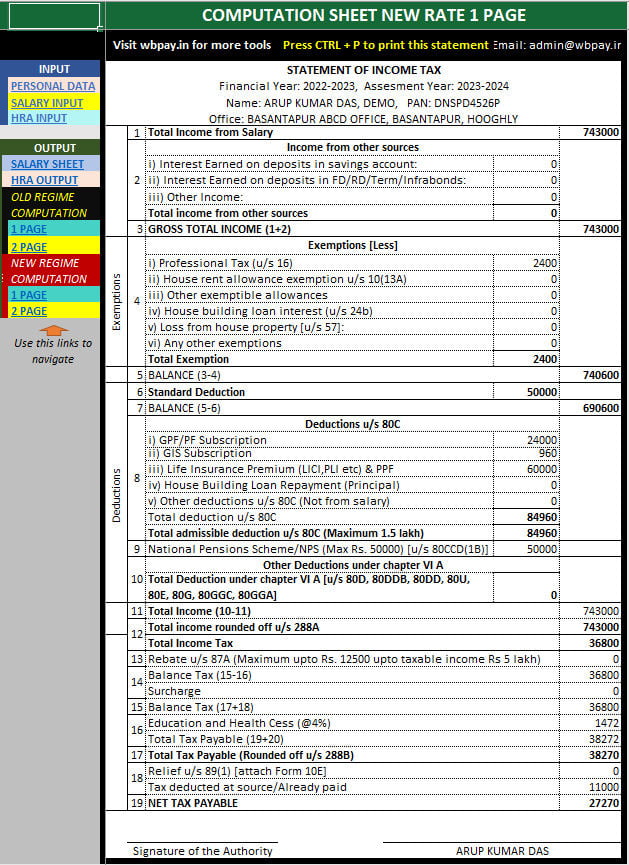

All in One Tax Calculator for the FY 202223, If you make $52,000 a year living in the region of ontario, canada, you will be taxed $14,043. Calculate your combined federal and provincial tax bill in each province and territory.